Audiobook Now Available!

I am beyond excited to announce that the audiobook version of The Currency Cold War is now available on Audible and other platforms. It is expertly narrated by James Barlow, a professional voice artist who made a great job of interpreting my words for a general audience. Enjoy!

Forbes article on Chinese digital currency

I wrote this article about China and digital currency for Forbes. Once it blew past 100,000 unique page views and was still being posted around on social media, I realised that the article must have touched a nerve somewhere! But the question is, what made the article so popular? Was it my brilliant analysis of the issues and the need for co-ordination between government and private sector, or was it Helen Holmes even more brilliant cartoon that precedes it!

with kind permission of Helen Holmes (@TheOfficeMuse).

Fintech Times

Philip Middleton, Chairman of the OMFIF Digital Monetary Institute, has written a kind review for the Fintech Times [PDF]. In the review, he says the The Currency Cold War is "erudite, contentious, sometimes obscure, occasionally infuriating, but always intriguing”.

Digital Currency Time

Why are we talking about digital currency now? There’s no single reason. It’s not because of any one change in technology or business models or regulation . We’re talking about digital currency because it’s digital currency time.

First Among Equals

The website Biblio-Fiend have listed their nine best books about the future of money and I cannot help but be a little flattered to find out that this book is the first of them! Here’s the ful list:

The Currency Cold War.

Blockchain Bubble or Revolution by N. Mehta, A. Agasha & P. Detroja (Paravane: 2019).

The Future of Finance by H. Arslanian & F. Fischer (Palgrave Macmillian: 2019).

Beyond Blockchain by E. Townsend (2018).

Before Babylon, Beyond Bitcoin by D. Birch (LPP: 2017).

The Internet of Money volumes 1-3 by A. Antonopoulos (CreateSpace: 2016).

Personal Currency by R. Colbourn & A. Riegelmann (Lionhead: 2016).

The Age of Cryptocurrency by M. Casey and P. Vigna (Macmillan:2015).

How Would You Like To Pay by B. Maurer (Duke University Press: 2015).

Needless to say, I was very flattered to be in such good company!

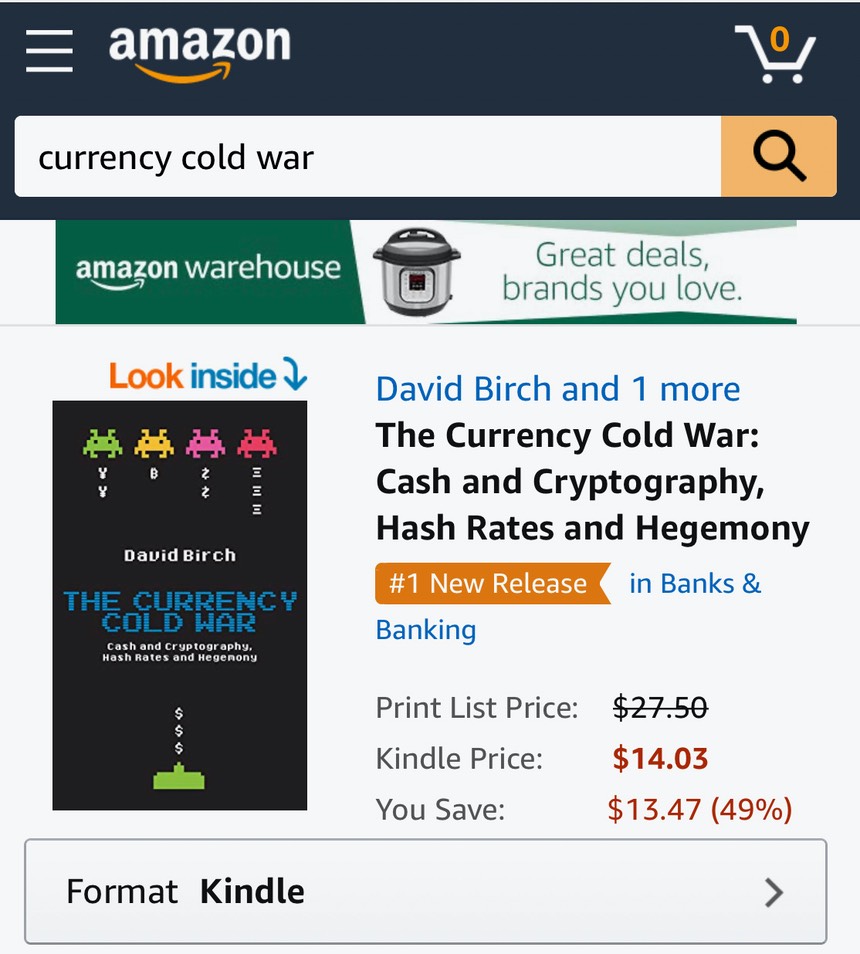

A First No.1

14th June 2020

Well, this is quite exciting. The book has made it to no.1 New Release in Amazon USA’s “Banks & Banking” category! Sincere thanks to all you kind souls who bought the book in its first couple of weeks out there.

It’s Digital Currency Time

I was interviewed by Penny Crossman for an American Banker podcast. Just as steam engines came along when it was steam engine time (all of the technologies and resources had been around for a while), so now it’s digital currency time.

The Safello Show

I’ll be discussing “The Currency Cold War” live on The Safello Show with Frank Schuil on Monday 1st June 2020.

Launch Webinar with Wordline

The wonderful people at Wordline are hosting a webinar to launch this book on an unsuspecting world. And it's FREE! And you can win copies of the book by asking a question! What are they like! I'll be having a conversation about digital currency and what it might mean with Nicolas Kozakiewicz, the Chief Innovation Officer at Worldline (and a very smart guy, so you should ask him tough questions too). Monday 18th May at 5pm CET be there or be square, as the kids say.